As the nation’s attention turns to the Spring Carnival, Gemba Group research highlights the youth problem that could cost the racing industry millions

CLIMBING EVEREST

In October 2017, the Australian sporting public was exposed to the first piece of true innovation to emerge from the racing industry in decades. The Everest – the brainchild of Racing NSW and the Australian Turf Club – saw Australia’s elite sprinters, piloted by our best jockeys, race for the richest prize pool in Australian racing and the largest winning purse of any turf race in the world. Pooh-poohed by many in the industry at the time of inception, particularly those south of the Murray, the Everest proved to be a roaring success, delivering the highest attendance at a Sydney race meeting for more than 20 years as well as record wagering turnover. The success of the Everest, and the marketing campaign supporting it, is no surprise to Gemba, as the concept meets many of the criteria critical to capturing a youth audience. The challenge, however, is for such innovation to become the norm and not the exception, thereby avoiding the disastrous consequences of an ageing and shrinking consumer base.

RACING’S YOUTH PROBLEM

Capturing the attention of millennials is the single greatest challenge confronting Australian sport, and in the metaphorical race to entice a youthful audience, the racing industry has missed the ‘kick’ and is floundering 20 lengths behind the leaders.

Viewership of racing has been in decline for some time – even the jewel in racing’s crown, Melbourne’s Spring Carnival, has taken a 5% hit on attendances since 2012 – and sadly, the sport’s age profile suggests this decline will only accelerate.

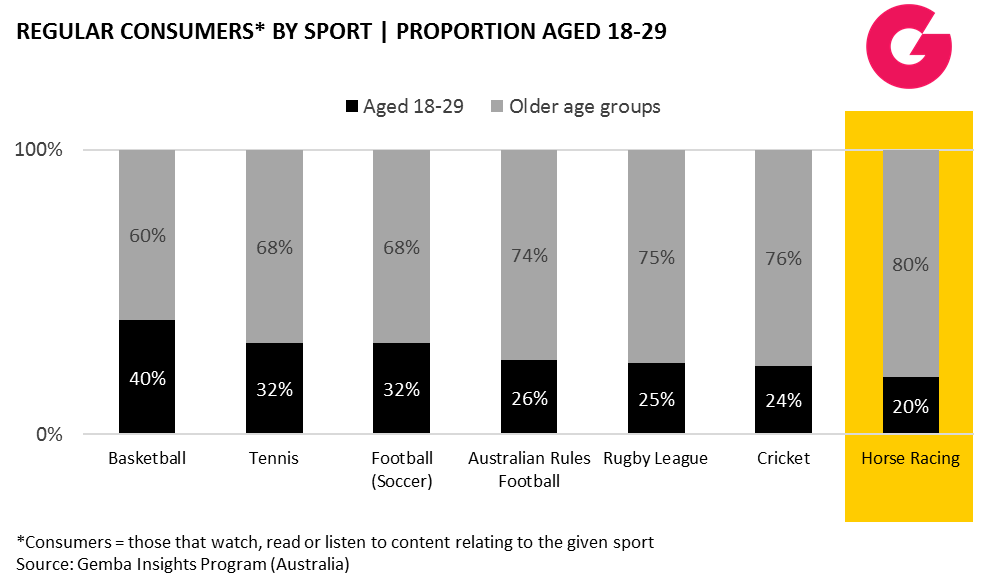

Gemba Group research shows that just 20% of the racing audience is between the ages of 18 and 29, which is the lowest proportion of the major sporting codes, and far less than that achieved by other forms of entertainment (think movies, music, electronic gaming).

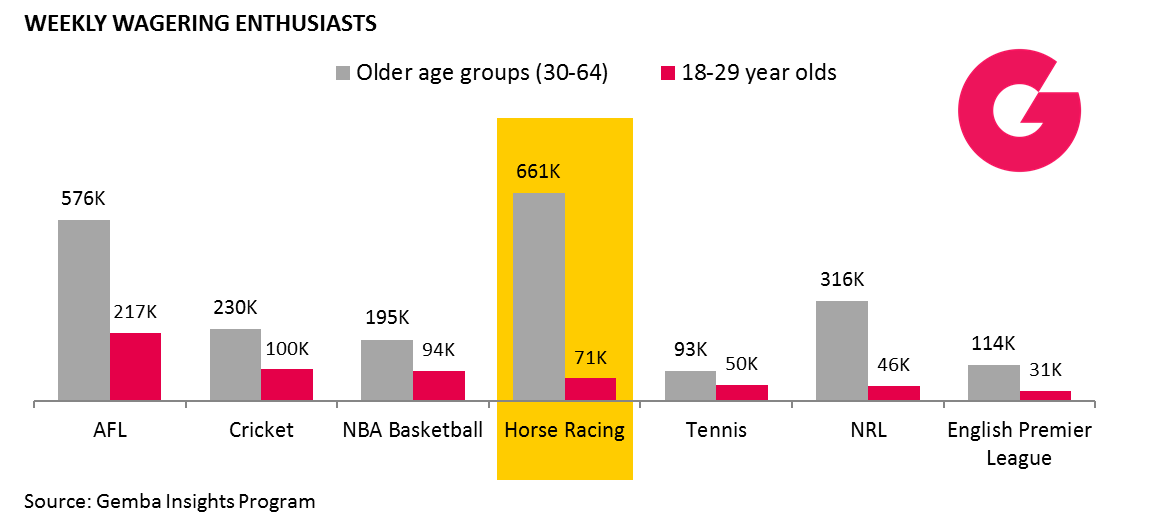

But even more concerning for the industry is an impending and potentially cataclysmic shift in the wagering customer base. Analysis of consumer wagering data has revealed that, despite racing currently possessing the largest number of weekly punters of the major sporting codes, the sport of kings is capturing fewer regular punters in the 18-29 age group than the AFL, cricket and NBA basketball.

Wagering revenue is the lifeblood of the racing industry. Without it, the sport simply doesn’t exist. Racing’s failure to attract a youthful wagering audience today, could translate into a momentous shrinking of market share in the future.

Gemba Group forecasting estimates that there will be 130k fewer racing punters by 2027 which represents a loss of approximately 20% of the current customer base. This in turn would translate into a decrease in wagering returns to the racing industry of more than $95m per annum (compared to today’s levels). This is a staggering amount of lost revenue, which would severely compromise racing’s business model.

THE SPORTS BETTING BOOM

It is no secret that the Australian wagering landscape has changed dramatically in recent times, with the influx of corporate bookmakers – armed with huge marketing budgets – driving turnover to new heights. Unfortunately for racing, however, a large portion of this growth is due to the increased popularity of sports (as opposed to racing) betting, particularly amongst younger demographics.

Why are millennials betting on sports over racing? Our analysis suggests the following factors are key to attracting the millennial wagering dollar:

- It starts with passion – evidence shows that for millennials, the first entrée into the betting world is invariably via the sports they are most passionate about. Why? With passion comes knowledge and insight, and millennials, like most rational people, want to bet on events for which they believe they can predict (or at least have an educated guess at) the outcome. Corporate bookmakers understand these factors all too well, with millennial sports (e.g. NBA, UFC) at the forefront of promotions targeting younger segments

- Access to data – millennials live in a digital environment, and are accustomed to using data to explain the world around them. Many mainstream sports realise this, and provide easy access to reliable and meaningful data via their digital platforms, which millennial punters harness to inform their betting activity

Racing is struggling to generate passion and interest amongst younger demographics. In the absence of passion, one would think that racing bodies would at least attempt to excel in the provision of accessible, reliable and digestible data to their punting customers. Sadly, this has not been the case, with racing bodies only recently taking steps to provide punters with data – such as sectional times – that has historically been the domain of third party, commercial businesses.

UNMASKING MILLENIALS

The challenge for racing is clear: develop a product that appeals to the younger generations, or sit back and watch the sport gallop towards extinction. But what is the key to engaging this audience? Our research points to a few critical factors:

- Star power – millennials are attracted by charisma and attitude. Their heroes don’t toe the line, they leap over it

- Global relevance – millennials have grown up with access to the biggest and the best from the world of entertainment. Their tolerance for mediocre, local content is minimal

- Interactivity – millennials want full immersion in their sporting and entertainment passions, with the ability to shape content and outcomes. The growth in electronic gaming and esports is no coincidence

- Intimate access – the proliferation of reality of TV and social media has conditioned millennials to expect behind-the-scenes access to their favourite heroes and villains. They want to see ‘real’ reactions, ‘real’ lives, all in real time

- Moments of consequence – the big hits, twists and turns. Millennials crave the moments that decide outcomes, shape storylines and demonstrate superhuman talents. And with a short attention span, millennials are the ultimate ‘highlights’ consumers

- Digital natives – millennials live in a world of devices and connectivity. They consume content when they want, and how they want. Digital accessibility is not a luxury, it is a necessity

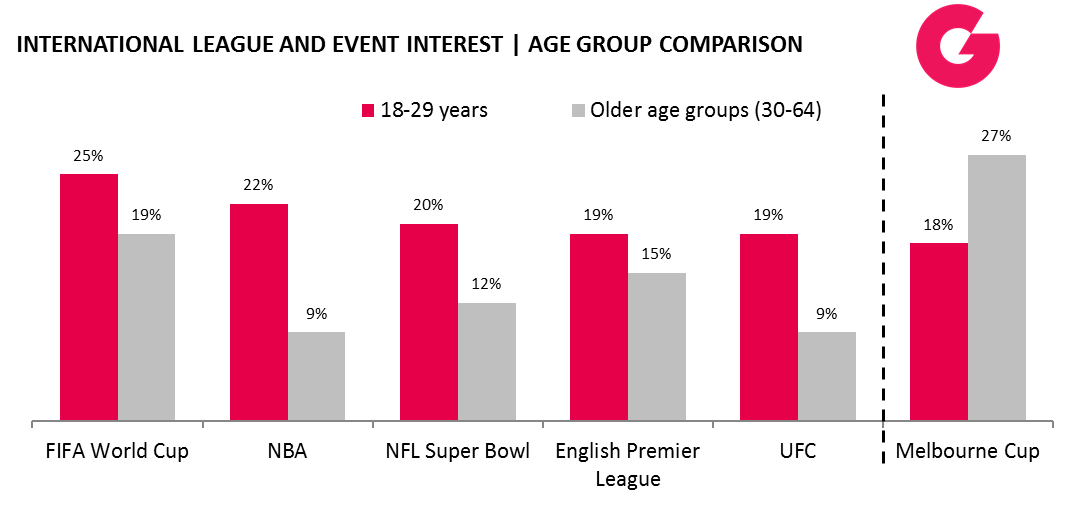

As an indication of the effect of star power and global relevance, we see younger Australians flocking to overseas leagues. Our research shows that the FIFA World Cup, NFL, NBA, UFC and English Premier League now create as much or more interest amongst millennials than leading domestic codes. This is despite the need to part with hard-earned cash for digital subscription services to access this content.

The roaring success of the Everest is no surprise, when you consider the concept drew upon many of the factors described above:

- Star power – the fastest horses in Australia and most elite jockeys

- Moments of consequence – a $10M prize purse, the largest in Australian racing, and the richest turf race in the world

- Global relevance – big prize money attracting international interest, augmented by the supporting entertainment (US pop sensation Jason Derulo performed for the crowd following the final race)

So how does the racing industry learn from recent successes, and claw back lost ground with the millennial audience? Below are some questions that should be at the top of the agenda for racing executives:

- Creating star power – who should the industry present as the figureheads of the sport to engage millennials? Who has the personality and attitude that will resonate with this group? Is it the jockeys, trainers or the horses themselves? Or even the big punters who make millions from their wagering prowess? Why can’t jockeys become the Formula One drivers of the racing world? How can the industry allow jockeys the freedom to show their personality, build rivalries and create the theatre observed in the UFC and NBA? If professional darts can create stars from overweight men throwing small projectiles at a board, surely racing can do the same with courageous jockeys riding huge animals at breakneck speed.

- Addressing product gaps – how can racing clubs deliver an on-track experience with more moments of consequence, more intimate access to the stars, and greater interactivity? Which racing club has the courage to break from the mould and significantly reduce downtime in between races? Racing carnivals as an entertainment package – with food trucks, music acts and fashion shows – have tried to deliver a more engaging experience, however, these efforts often ignore the sport itself with minimal conversion from attendees to genuine racing fans

- Streamlining digital delivery – how can racing bodies work together to create streamlined and efficient digital racing content? How can existing platforms be combined to avoid fragmentation of the fan base? How does racing produce content that packages the moments of consequence for easy and quick consumption by a younger demographic with short attention spans?

- Reinvigorating the punting experience – how can we provide streamlined, accessible and usable data to the punting community? How can excitement be brought back to the on-track betting ring experience? Can fast-paced, high-stakes trading action be incorporated into the racing brand? How can racing create competition amongst punters, and incorporate concepts of gamification in the punting experience?

None of these questions have easy answers, but unless they’re addressed, the odds of racing remaining relevant are 100 to 1.