We have witnessed a seismic shift in women’s sport over the past 3 years. Female athletes and leagues are part of the mainstream conversation and their stories are more often compelling than their male counterparts.

The emerging challenge for both rights holders and sponsors is understanding how to price women’s sponsorship packages. It is becoming more evident that the traditional approach to pricing significantly undervalues the large positive sentiment of women’s sport.

The current approach to sponsorship pricing has been predominately underpinned by an obsessive focus on eyeballs. This is becoming increasingly problematic for men’s properties but is massively detrimental to the pricing of women’s properties.

Why is this? We think that while many people are not watching yet, sometimes through lack of access, there is tremendous good will about the growth of women’s sport. A clear majority of people think that growth in women’s sport is a great societal outcome and we suspect that this is driving engagement with the content. It may not be traditional viewership yet, but there are signs of growing engagement across social media, checking of results and general affinity with teams, leagues and athletes.

As Gemba rolls out its global pricing platform, Turnstile, the data is clearly showing that the value proposition for women’s properties is significantly different to that of men’s.

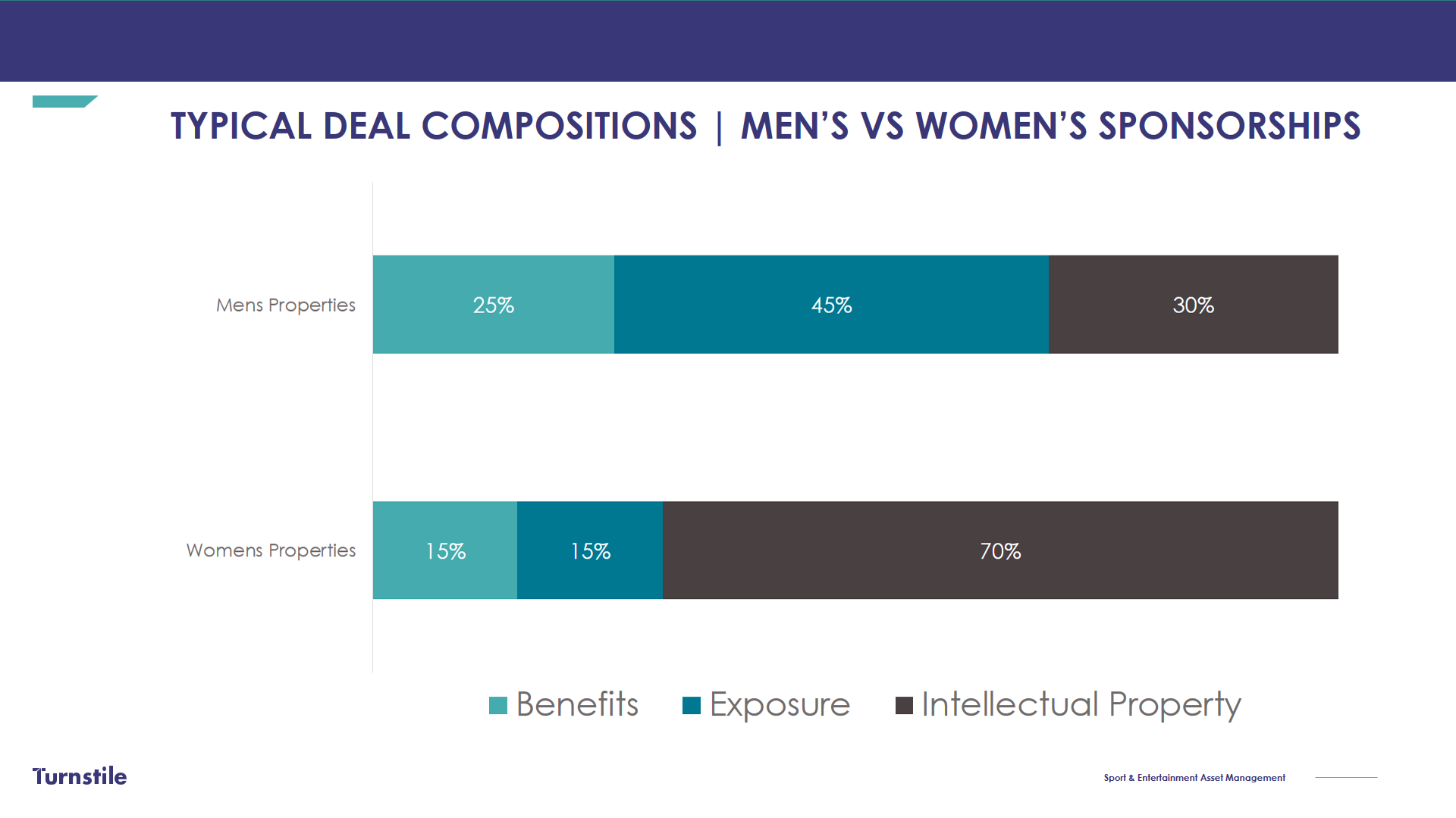

While broadcast audiences for women’s leagues and events are growing, they are quite often significantly less than the equivalent men’s content. Yet, Turnstile’s global fan base research is showing that women’s sport is often closer to men’s sport when the total number of fans is calculated. In turn, we know that the number of fans correlates to the Intellectual Property component of a sponsorship deal. As a result, we are seeing different deal compositions for men’s and women’s properties.

So, while a sponsor may not receive high levels of exposure from a women’s property, they are accessing highly relevant Intellectual Property that can be leveraged via marketing campaigns. Look at how Ernst & Young are using the women’s Rugby World Cup to drive their diversity and inclusion proposition message. Look at Nike’s Serena Williams messaging in the 30th anniversary of their iconic Just Do It campaign.

This in turn has another implication. It becomes even more important for sponsors of women’s sport to leverage their investment. The relatively low level of exposure generated, means that the sponsorship proposition needs to be communicated through sponsor funded marketing. So, while the sponsor may not be paying the rights holder for high levels of exposure, they will need to allocate funds to drive the sponsorship through their own marketing and owned media channels. Given the developing nature of many women’s leagues and events, this leveraging money is strategically important to rights holders as they look to broaden their reach and deepen their engagement.

By recognising and quantifying the value of Intellectual Property of women’s sport properties, rights holders will unlock further value and buyers will have a pricing mechanism to justify their investments. In turn, the pricing sophistication of women’s sponsorship may in fact surpass the current exposure obsession that prevails for men’s sponsorships.

THREE TAKE AWAYS

– Women’s properties need to be priced with an understanding of Intellectual Property value not just Exposure

– Brands will need a commitment to leverage to tell the story

– Women’s properties have the potential to benefit from increased brand leveraging campaigns