Gemba Group research highlights the shooting stars of the global sporting marketplace

Buy low. Sell high. The goal of every share trader in every stock exchange around the world. Simple in theory, but difficult to execute. Whilst we don’t profess to know the first thing about the inner workings of the Dow Jones or Hang Seng, we do know a thing or two about sports. Sadly, a sporting stock exchange has yet to materialise, but what if you could trade in your favourite leagues and events? Which sports stocks would you buy today, knowing prices are set to soar? Which sports have reached the peak of the mountain and should be cashed out? Our analysts have put their minds to answering these questions, and have some interesting results to share.

PICKING A WINNER

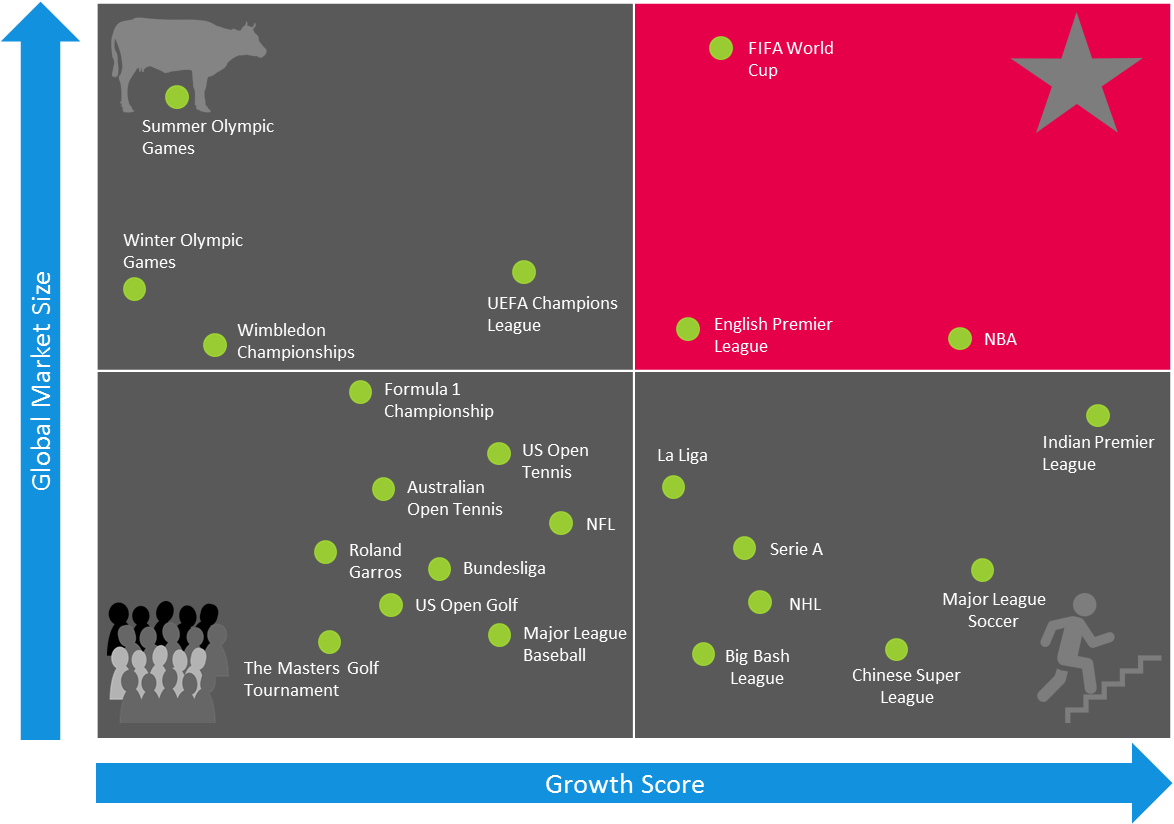

The first step in any successful investment strategy is determining the true worth of a stock based on its current and future prospects. To do so, we harnessed the power of Gemba’s global consumer research program, and assessed major sporting leagues and events using two key inputs:

- Global market size – the number of people with high passion and interest (across key markets in Europe, Asia and the Americas)

- Growth score – a combination of the portion of each fan base that are in youth segments (i.e. under the age of 30), and the portion that reside in emerging markets (e.g. China, India, Brazil)

The results of this analysis were subsequently plotted on the Gemba Stock Matrix (see diagram below), and revealed which leagues and events were worthy of the following categories:

- Stars – the hottest of hot. Huge market size and strong growth predicted

- Cash cows – large market size but only modest (if any) growth predicted

- Climbers – under-valued stocks with high growth prospects

- The Pack – have potential, but need to improve on one or both key metrics

So, what do you do with the above information? Read on for our trading tips.

GOING LONG

Someone get Gordon Gekko on the phone. We’re cashed up, confident and ready to go all-in. Our first investment? The NBA. With a large, global audience, and a product built to capture the hearts of gen Z – brash personalities, constant action, digital access, highlights reels – the NBA is the first picked in any stock line-up.

Next cab off the rank is the FIFA World Cup (no surprises here). With the largest market size of any sporting asset, and huge interest amongst global youth and emerging markets, the pinnacle of the world game is a must in any sporting portfolio.

With those stars locked away, it’s time to diversify, and add a couple of climbers to the mix. The first is Major League Soccer. For years the ‘poor cousin’ of the indigenous American codes, the MLS is on the rise and riding the wave of global football interest. Our next investment is in the ‘rock star’ of cricket formats, T20, with a dual-stock strategy combining the Indian Premier League and Australia’s Big Bash League. Both products were developed for the younger generations and, with the weight of the cricket-mad Indian population behind them, look set for a healthy future.

SELL, SELL, SELL!

Your parents probably won’t like this, but we’re selling the Olympics. Summer and Winter. For many years the jewel in the sporting crown, our analysis suggests the Olympics has reached its apex and can only go one way from here. Sure, the current fan base is large, but with far less engagement among younger generations, and the lowest growth score of any asset, we’re cashing out now.

And our shorting of iconic sporting events doesn’t stop there. Our shares in the Wimbledon Championships are also up for grabs. Unless the darling of the tennis world can give itself a make-over to attract a younger crowd and non-traditional markets, we can’t see its price rising anytime soon.

RISING ABOVE THE PACK

The global sporting landscape is a competitive one, evidenced by the sports that find themselves in our final quadrant – the Pack. Finding the hidden gems here takes a trained eye, but we have a couple of stocks worth your investment. The first is the Australian Open. Easily the most innovative of the Grand Slams – the event now incorporates a plethora of entertainment options catering for sport fans, music buffs, entertainment junkies and foodies alike – and in close proximity to the burgeoning Chinese tennis market, we expect the Australian Open to jump into the Climbers quadrant quick smart.

We are similarly bullish about the F1 championship which, backed by new owners Liberty Media, will inject a more liberal approach to the creation and distribution of content – harnessing social media channels to broaden reach, and allowing greater access (and freedom of speech) to teams and owners to attract younger audiences.

On the flipside, we have bad news for golf investors, as your assets don’t appear to be in high demand. With little global investment in R&D, and a product portfolio that hasn’t changed materially in the past 50 years, you might have to hold on to your stock and hope for the best.

The same can be said for Major League Baseball. Whilst other American sports have delivered growth through international penetration, the “national pastime” has rested on its laurels, and now finds itself with an ageing, and shrinking fan base.

INJECTING VALUE

So, what can sports do to improve their growth prospects? The answer is to learn from the stars and climbers, and employ the following strategies:

- Know your audience – invest in developing a deeper understanding of your current and potential audience, their interests, habits, needs and attitudes. Without this, you are flying blind.

- Investment in R&D – be prepared to take risks on new technology, systems and products to improve fan experience and tap into youth and emerging geographic markets.

- Build products for the younger generation – we know that today’s youth are demanding and time poor. They are seeking maximum excitement in minimum time, intimate access to stars, and greater involvement and interactivity in the game/outcome. Unfortunately, very few sports have evolved to deliver this.

- Global outlook – don’t be afraid to look outside your core audience to markets that are growing, and have a culture that aligns to your natural strengths.

None of the above is rocket science, but without it, we can guarantee that you won’t see your stocks rising anytime soon.