The social media juggernaut is challenging traditional sports broadcast models in Australia and around the globe, through seamless access and compelling consumer preference. On December 2nd at the National Broadband Network’s Discovery Centre in Sydney, Gemba presented our fourth #goingtogemba event to investigate the shifting broadcast landscape.

__________________________________________________________________________________________________________________

For a while now, a shift has been taking place in sports broadcasting.

TV consumption and passion for sport in Australia have been trending down, which is directly impacting ratings and viewership. This is a problem not just confined to the Australian marketplace; The world’s largest sporting leagues such as the NFL and EPL have experienced similar trends in 2016, while subscriber-based ESPN has been facing record levels of ‘cord-cutting’ in the US.

2016 saw a flurry of activity in the sport social media space. Social companies acquired rights to stream NBA, Rio 2016 (through a content deal with NBC), PGA Tour events, the Melbourne Cup and the game-changing deal that signaled a ‘coming of age’ for social media streaming; Twitter’s deal with the National Football League. Ten Thursday Night Football games simulcast live on Twitter for $10m. It was a deal not about money, but reach. NFL & Twitter connecting with new audiences and promoting ease of access in a bid to engage with passive fans on a global scale.

This trend should come as no surprise. Since its very beginning, social media has had a strong connection to sport. It started as a conversation, banter that evolved to include rich digital content. Now it is going live. As consumers disconnect further from traditional channels (particularly the younger generations), broadcasters and sport rights holders are now dealing with a traditional broadcast model that is under pressure.

This #goingtogemba event presented insight and opinion from key players in the industry. Dale Wood, Gemba’s Head of Strategy and Head of Insights, gave an overview of evolving consumer behaviors, while guest speakers, Jonno Simpson from Twitter Australia and Tom Brady and Henry Hodgson from the NFL spoke about the importance of social media broadcasting for rights holders in the immediate future.

There were three key take-outs from the event:

- Opportunity for all – we should not assume that traditional broadcast is competing with social media broadcasting for eyeballs. Less frequently are their audiences overlapping. The NFL’s audience profile on Twitter demonstrates this. For its five games broadcast on Twitter so far this season, 83% of streamers have been under the age of 35, while for broadcast this is only 27%. Social media companies are looking to partner with rights holders and traditional broadcasters to promote sport and increase its reach.

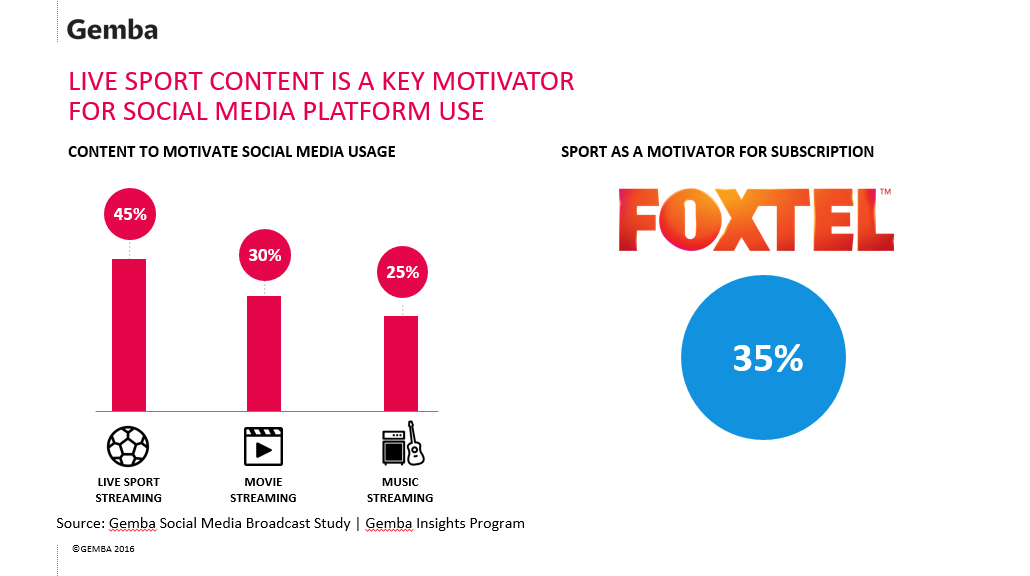

- Sport is sticky – the exponential increase in media rights fees has highlighted the importance of sport content for traditional broadcasters. Sport has this same appeal to social media companies. Gemba’s research has found that 45% of consumers surveyed say that live sport streaming would motivate them to use social platforms. This compares to 35% suggesting that sport is their main subscription driver for Foxtel (Australian subscription TV service provider)

- Rights holders risk losing a generation of fans – Younger consumers aren’t engaging with traditional platforms en masse. If content is not readily available, younger consumers can’t be reached. Gemba’s Digital Segmentation finds 86% of consumers between the ages of 16-34 are digitally active. This ranges from frequent social media use, through to frequent streaming OR both. TV is an important part of a sport’s strategies, however by ignoring platforms where young consumers are already engaging (i.e. social media and/or digital), rights holders risk losing an entire generation of fans

So what does this mean for rights holders? Sport is valuable to social media and remains so for television. By aligning to consumer preferences for social media streaming, sports can build a pipeline for the next generation of fans. We believe this can create value for rights holders over a number of platforms. We are calling it calculated fragmentation: a deliberate strategy to increase reach whilst increasing revenue from rights and assets.

The New Broadcasters are already here, and more are knocking on the door. These mass and niche platforms can provide tremendous upside to rights holders who are willing to embrace this calculated fragmentation.